Debt Consolidation Loans

Combine multiple debts into one manageable payment. Ideal for credit card debt, medical bills, or other high-interest obligations. Potentially lower your monthly payments and total interest paid.

We've researched the best personal loan and insurance options to help you find the right fit for your needs. Compare rates, features, and benefits below.

FinanceBuzz’s list of no-interest credit cards helps you avoid costly interest charges while you pay down balances or make large purchases. These 0% intro APR cards are handpicked to help you save money, simplify payments, and get out of debt faster—without changing your lifestyle.

• 0% intro APR cards designed to eliminate interest charges

• Ideal for balance transfers, big purchases, or debt payoff

• Expert-curated list comparing top offers in one place

2025 Award-Winning 0% Intro APR Credit Cards

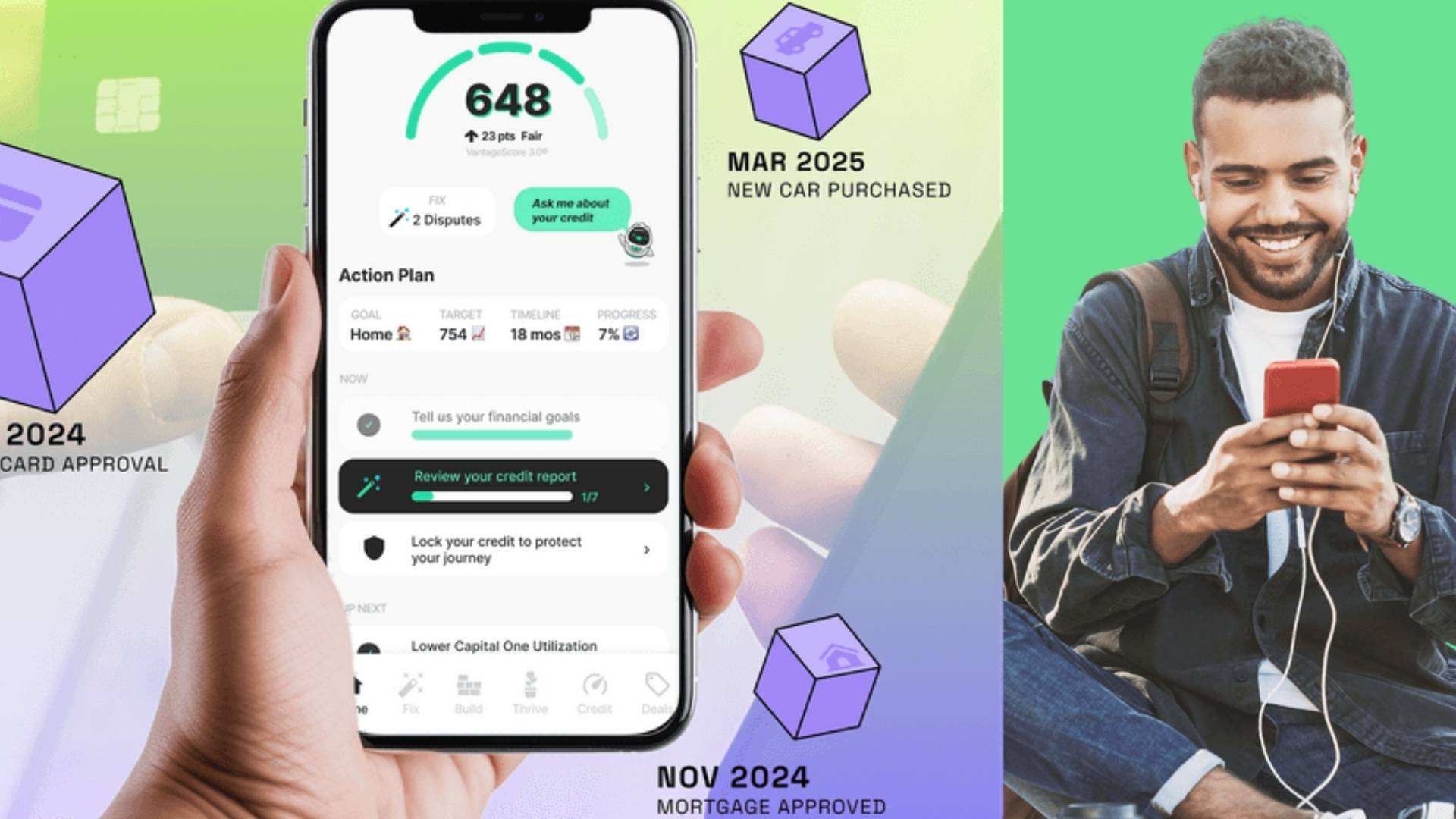

Dovly helps you build and protect your credit by automatically reporting on-time payments, monitoring your credit profile, and disputing errors on your behalf. With simple setup and ongoing support, it makes improving your credit score easier—without stress or complicated steps.

• Automatically reports positive payments to help boost your credit score

• Credit monitoring and error dispute assistance included

• Simple setup designed for long-term credit health

As Seen On

RateDriven helps drivers—especially seniors—refinance their auto loans to secure lower interest rates and reduce monthly payments without trade-ins, gimmicks, or hidden fees. Using a free online tool, you can see your new rate in about 30 seconds and find out how much you could save each year.

• Rates as low as 4.99% APR for qualified drivers

• Average savings of $2,100+ per year with refinancing

• Fast, free online check with no impact on your credit score

Top Rated Auto Refinance Program Trusted by Drivers Nationwide

Top Rated Auto Refinance Program Trusted by Drivers Nationwide

If your New Year’s resolution is to reduce debt, simplify payments, or lower monthly bills, NerdWallet’s Personal Loan Analyzer helps you compare personalized loan options built for exactly that. In minutes, you can explore consolidation and personal loan offers from trusted lenders—free to use and with no impact on your credit score.

• Compare debt consolidation and personal loan options in one place

• Flexible terms to help lower monthly payments and simplify finances

• Free to use with no impact on your credit score

Trusted by Millions to Make Smarter Money Decisions

Trusted by Millions to Make Smarter Money Decisions

Discover the impact TurboDebt can make on your finances. Their program has the potential to save money on your credit card debt. Start your journey toward a debt-free future today, and find out how much you can save!

* “Debt-free” applies only to enrolled credit cards, personal loans, and medical bills. Not mortgages, car loans, or other debts.

We may receive compensation when you click on links to products. This does not influence our evaluations, but it helps support our site. Rates and terms are subject to change.

Combine multiple debts into one manageable payment. Ideal for credit card debt, medical bills, or other high-interest obligations. Potentially lower your monthly payments and total interest paid.

Finance your home renovation or repair projects without using your home as collateral. Perfect for kitchen remodels, bathroom upgrades, roofing, or energy-efficient improvements.

Fast funding for unexpected expenses or medical bills. Quick approval process and flexible terms help you manage financial emergencies without depleting savings.

Options for borrowers with less-than-perfect credit. While rates are higher, these loans can help you access funds and potentially rebuild your credit with on-time payments.

Compare auto insurance quotes from multiple top-rated carriers. Find the best coverage for your vehicle at competitive rates. Bundle with home insurance for additional savings.

Protect your home and belongings with comprehensive coverage. Compare policies that cover dwelling, personal property, liability, and additional living expenses.

Protect your family's financial future with affordable life insurance. Compare term and whole life policies from leading carriers. Many options require no medical exam.

Find health insurance plans that fit your budget and coverage needs. Compare HMO, PPO, and high-deductible plans. Check if you qualify for premium tax credits or subsidies.

Affordable protection for your personal belongings and liability coverage. Essential for renters to protect against theft, fire, water damage, and accidents in your home.

Visit our main site for in-depth guides, calculators, and expert tips on personal loans and insurance options.

Back to HomeThe information provided is for general informational purposes only. Rates, terms, and availability vary by lender/insurer and are subject to change. APRs shown are estimates and actual rates depend on credit score, income, and other factors. Always read the full terms and conditions before applying for any financial product. We may receive compensation from partners when you click links or apply for products, which helps support our site but does not affect our editorial opinions.